You wear many hats as an entrepreneur.

For example, you are a salesperson in the morning, a recruiter in the afternoon, a marketer and strategist in the evening, and a thinker at night.

You also need to don the hat of a skilled accountant to save yourself from cash flow-related issues.

But what if you don’t understand the finance side of the business well?

You see, hard work and innovative ideas are a great starting point for a successful business, but most ventures fail within the first five years because of financial issues. In most cases, these issues are preventable.

You may be tempted to invest most of your funds in marketing to generate leads and increase profits. But instead, it is worth looking at another component of a successful business: cash flow.

Unlike profit or income, your business’s cash flow measures the actual cash present in the business.

Cash flow alone might not give you a comprehensive picture of how your business is doing. However, a business that suffers from a lack of cash will undoubtedly run into trouble and fail eventually.

That’s why you need cash flow control.

What Is Cash Flow Control?

“Cash flow control is your ability to control cash outflow based on predicted and planned cash in flow, so that you have minimum cash balance required to run your business, at all times”– Shishir Khadka

What do I mean by this?

When you are driving a vehicle, your ability to control the vehicle determines how safe the journey will be and your ability to increase the speed confidently.

When it comes to running your business, your ability to control investments and predict cash inflow is super important to have control in your business.

To do this, you need to have cash flow control.

Remember,

Cash Flow Control = Control in Your Business

Cash Flow Management + Cash Flow Analysis + Cash Flow Projection = Cash Flow Control

In this section, you will learn why understanding and controlling cash flow is so important for an entrepreneur. I’ll also share the best strategies to make your business’s cash work harder for you.

Why Is It Important To Educate Yourself About Cash Flow Control?

To understand if a business is successful or not, we look at its annual profits or its income first. Undoubtedly, a business’s profit and loss statement is vital to understanding its position in the market.

But don’t be fooled. Significant profits or thousands of pounds of income don’t necessarily mean that the business is healthy or successful.

To understand this, pair the profit numbers with the cash flow numbers.

Let’s say that your company buys £2,000 worth of supplies and sells them for £2500 on credit.

Now, the profits of this transaction might be £500, but because of the credit, no cash is entering the business, making the cash flow nil.

Your business can’t count on immediate profit. It cannot pay salaries, suppliers, and contractors out of profit. Many companies face such cash flow situations and operate for a limited time before shutting down because of cash flow problems.

Luckily, there are several ways to keep the financial risks associated with a negative cash flow at bay. I’ll share them later.

But first, as an entrepreneur, you need to have a clear picture of what cash flow is, why it is important, and how to control it throughout each phase of your business.

Let’s understand it by looking at the difference between successful and failing businesses.

The Difference Between Successful And A Failing Business

How can you know if your business is successful or failing?

According to Investopedia, there are four main reasons why businesses fail.

- Financial hurdles – meaning lack of working capital to support day to day running of the business

- Lack of business acumen – knowing how to run a business and service clients

- Ineffective business planning

- Marketing mishaps

A business can experience all or some of these on its way to business failure.

But, in general, if you type why businesses fail in Google, this is what you will see first.

The first reason you see is inadequate working capital, i.e., cash flow to run day-to-day operations as the biggest killer of the business.

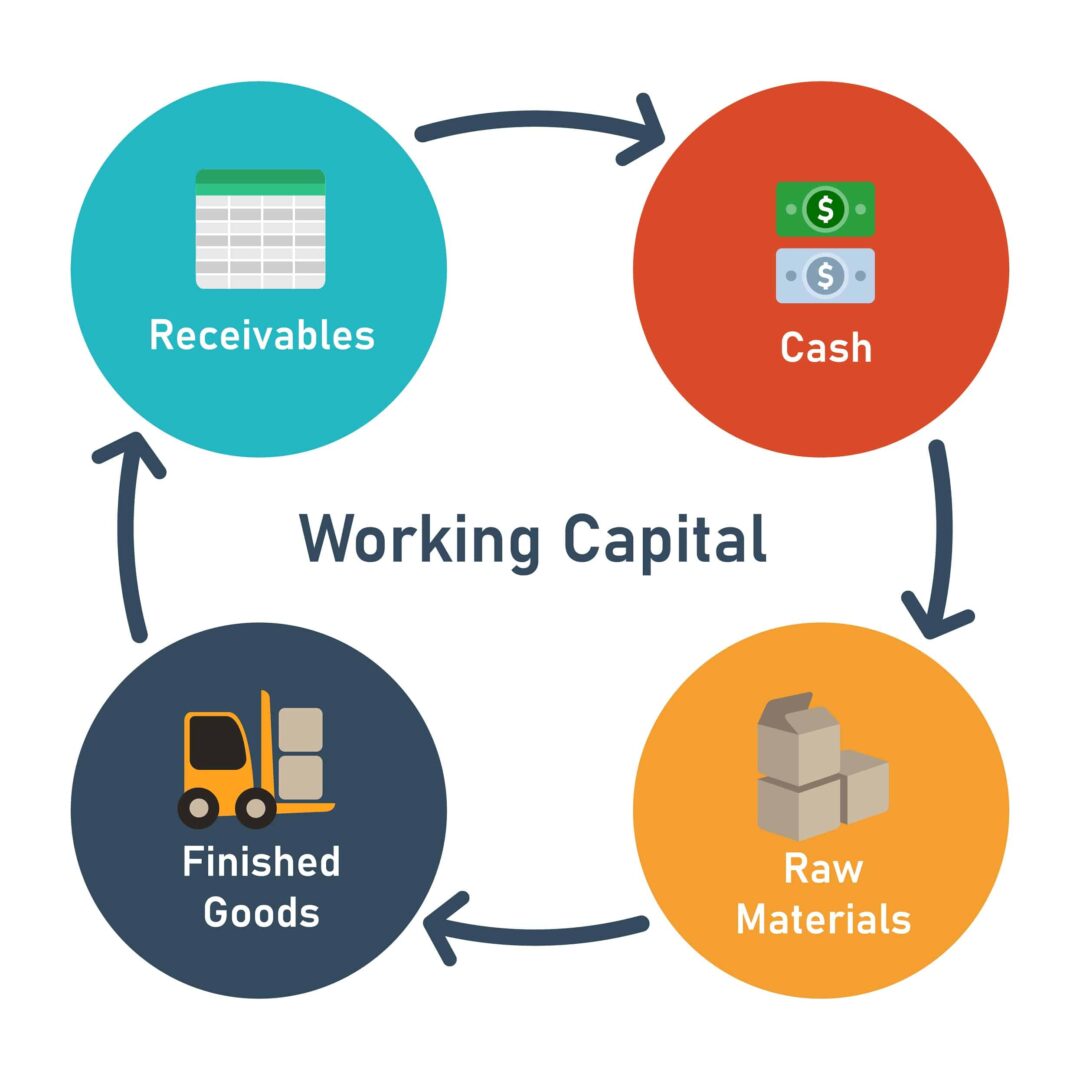

Your business creates working capital when profit turns into cash flow.

That’s why the profit and loss statement, when used alone, does not give you a clear picture of the position of a business in the market as it only shows how profitable the business is.

You also need a cash flow statement to figure out your working capital.

So, what does measuring business success mean? And, how to be a successful business?

A successful business is set up for survival and growth in the long term, can foresee cash flow shortfalls and obstacles, and has a backup cash flow plan ready for emergencies.

Therefore, the breakneck growth of a business or an expanding business that only aims at generating leads might not result in a successful long-term venture.

Ultimately, the difference between a successful and a failing business is its ability to control cash flow to support a long-term vision.

The Cash Conversion Cycle

And, The Role It Plays In Controlling Cash Flow

Now you know what cash control is and why it is important for you to educate yourself on the financial side of the business as an entrepreneur and take time to understand how to control your business cash flow.

Let’s start by understanding the Cash Conversion Cycle (CCC).

The Cash Conversion Cycle is a measure of cash collection over time. It tells you how fast your business can convert an investment into cash. The business capital investment will be first converted into inventory and payables, then into receivables and sales, and finally back into cash.

Therefore, the fewer days to convert an investment into cash flow, the better is CCC and the healthier the business is.

If your business takes too long to convert an investment into cash, one of the simplest things you can do is have credit control in place for receivables.

This leads us to the next section, where I share how a small business owner can stay on top of cash flow.

How Do You Stay on Top of Cash Flow as a Small Business – A Conversation With One of My 7 Figures Clients

Steve runs a successful marketing agency based in London, earning £1.3m a year. His business has grown from £813k from the previous year. His business works with some of the biggest brands in the world to develop their marketing strategy and helps them in executing this strategy.

Business growth has affected its cash flow. As a result, Steve hired three project managers, one full-time operational manager, and a junior graphic designer to share some of the senior graphic designer’s workloads. He has also hired a few freelance copywriters to help with the new project workload.

Steve feels he is busier than ever. He is happy his business is growing, but he is frustrated and concerned because the cash balance is going down every month despite his monthly revenue increase.

We catch up on our quarterly cash flow clarity and confidence-building meeting.

Here is how the conversation went on a recent call.

Steve – “Shishir, good to catch up after three months. How are you?”

Shishir – Steve, I’m good. Thanks and you.”

Steve – “So how do I stay on top of things? I mean, as you know, my business is growing, but the cash position is poor.”

Shishir – “Steve, I am looking at three financial statements to understand what’s going on in your business. First, your profit and loss statement tells me that your overhead expenses have increased by 22% compared to the previous quarter, which will negatively impact your cash flow.

Sales have increased by 25% compared to the previous quarter. However, delivery costs have increased by 30%, hurting your cash flow.

Net cash flow, which is cash inflow less cash flow outflow, is down by 19% compared to the previous period, and your debtor’s balance has increased by 41%. Oh. That’s a significant increase. This all contributes negatively to the current cash flow position.

By the way, did you also put in £15k in the business this month? I am seeing significant amounts going in and out. So it looks like you’ve got the money to cover the salaries.”

Steve – “Yes, Shishir. So one moment I am doing well when I look at a big invoice I sent to the client, like this £75k I sent the other day. The next moment, I see the cash in the bank drying up, and I don’t want to face embarrassment and disappointment in front of my employees, so I put in £15k to cover payroll. Sometimes I feel helpless, juggling cash, who to pay, how much, and when.”

Shishir – “Steve, you need to make some changes to how you operate.”

Steve – I know Shishir. Tell me what is hurting my cash flow and how to fix it. I am all ears?”

Shishir – “There are seven levers that affect cash flow. Sales price, volume, delivery costs, overheads, receivables, payables, and inventory. As you can see, an increase in overhead expenses by 22% that’s an additional cash outflow you paid or have to pay to keep your business running. Costs of delivery also increased by 30%. I am looking at your payables *, and it seems like you have paid most of the creditors well on time to keep them happy while you are still waiting for some large invoices to be paid from your client.

Why can’t you invoice them in stages or segregate the large invoices into small packages? Like this one, you sent for £75k.

If you had invoiced for strategy, initial research, consultation, and plan of action for £20k last month, you could have £20k by the end of this month, and then you wouldn’t have to put in £15k from your account, would you?”

Steve – “Ok, let me speak to my client on this. How can I identify cash flow problems early? So that I don’t end up in this situation.”

Shishir – “Steve, it comes down to having cash flow self-awareness. You’ve got to be aware of cash inflow, cash outflow, and overall net cash position every month. Your debtors have increased by 41%. Do you have credit control in place to collect the payments on time?

Steve – “I don’t have. I send out invoices quickly as soon as the work is done on most occasions. But sometimes, invoices are returned. Either the purchase order is missing or incorrect, or the invoice is not delivered to the right person. Whatever it is, it’s frustrating when our money is tied up elsewhere, and I have to put money from my savings account to cover bills to pay.

Around the 20th of the month, I have this moment. Will I have enough cash to pay for big monthly spending like payroll, monthly retainer fees of marketing folks, freelancers’ last month’s bills? And I haven’t thought about myself yet. So, how do I control cash?”

Shishir – “Here are some of the actionable things you can do immediately.”

I am now sharing what I shared with Steve about controlling their cash flow situation.

What To Do To Control Your Cash Flow Situation?

Here are ten things one can do to control the cash flow situation in their business.

1 | Cap the Maximum Spend in a Month

Choose the upper limit of your monthly spending by knowing the point, expenses beyond which will hurt your profitability or create losses.

You may say I’m only going to spend £10,000 maximum in a month. And I’ll stick to that limit even when there is an opportunity to buy a product for much less or there is a chance to invest in a program. You only spend whatever is possible within the maximum spend limit you have set for yourself.

Let’s say the fixed cost in your business is £8,500, and you have a £10,000 spend cap. So you only have £1,500 to cover all other expenses in your business. And you know if you go over £10,000, you may start making losses in your business or go below the profit target you’ve set for yourself.

We establish a capital expenditure limit with clients I work with, and we don’t go beyond that. We don’t buy from emotions and stick to our spending limit.

It’s like, you get your pocket money, and there is £100, £1000 or £2000 in a week. That’s all you have. So you make the best use of that money and can’t spend any more. And this way, you are able to control your cash flow.

2 | Keep an Updated Cash Flow Statement

Remember, your cash flow statement is like your mark sheet.

When you go to school, you get grades or marks depending on where you studied. Either way, you get a score that tells you how you performed in certain subjects.

In the same way in business, you get three kinds of reports, cash flow statement, profit & loss statement, and balance sheet. You can use cash flow statements to manage, analyze and project cash flow. When you do all three (i.e., manage, analyze, and project cash flow), you are in an excellent position to control cash flow in your business. So, a cash flow statement is something that you need to control cash flow.

If you want to take a deep dive into how it all works, you can watch this video, which refers to the MAP Method. It is a method that I created to help entrepreneurs like you control cash flow by way of Managing, Analysing, and Projecting their cash flow. You will get more insights by watching.

3 | Focus and Work Towards a Single Goal

Noah Kagan, the founder of AppSumo, was hired by Facebook at age 24 as the company’s 30th employee.

In an interview, Noah shared the No. 1 insight he gained from his short-lived Facebook career: “When you are running your business, have one goal. That’s it.”

Noah also wrote about how at Facebook, they made every single decision through the filter of “Does this help user growth?” So if a feature did, they would make it. If not, they wouldn’t.

He shared a personal story where one time he went to Mark (Zuckerberg) with an idea to monetize Facebook, and all he did was write “GROWTH” on a whiteboard. He wasn’t interested in monetizing in the early days, only in user growth.

Later Noah used that singularity of focus to become the founder of an 8-figure business.

I aim to use a similar focus on my business. That’s why I communicate our spending, what we are making in a month, and our monthly goal with my team.

Then when I get an idea to start a campaign, I discuss it with my team, and they say, “Why are we going there because that does not help us move towards our goal?” Such conversations keep us focused and help us stick to our plans.

So having a single focus with accountability built-in is important.

This is something that I teach in the Profit Pioneer program. In the program, I share how anyone can have this singularity of focus in their business to get accelerated results. By adding up small things to help towards one goal, you can create a massive transformation in your business.

So, to control your cash flow, have a singularity of focus, one monthly goal. Then, decide what commercial actions you are going to take towards that monthly goal. And make sure everyone on the team knows at the beginning of the month.

4 | Use Cash Flow Apps and Win With Data

Good cash flow apps save you time.

Using them, you can build what-if scenarios for cash flow forecasting and decide how to prioritize spending in the business.

With a cash flow forecast, you can ask yourself whether you can spend money on something or not? And be confident in your decisions. That is why I say financial data drives decisions. And, so what you do commercially is all driven by data.

You can grow your business by measuring the metrics of the data. For example, the creator of a YouTube course I have been part of says that one can grow their YouTube channel by measuring the data of what’s working and what’s not working.

I double down on what’s working. And when I learn something doesn’t work, I drop that. It’s the same in business.

Find out what’s working for you in your business by measuring the financial data. For capturing financial data, you can use cash flow apps. I have given an overview of 5 such apps in this video.

With these apps, you can build what-if scenarios and come up with what you can do. By doing that, you’ll have control over your cash flow.

5 | Do Not Ignore Small Cash Leaks in the Business

At times, we take things for granted.

We see a small $10 leak a month and ignore it.

It’s like if I ask you, “Can you hold this pen for 5 seconds?”

You’d say, “Sure, that’s not a problem.”

What if I asked you, “Can you hold this pen for 5 minutes?”

Then you start to think about it.

What If I asked you to hold it for 10 minutes or 1 hour.

Even if you can hold it for that long, it will hurt badly.

Suppose I asked you to do it for 24 hours. You’d probably say that you can’t do it.

It’s the same in your business because a tiny hole, over time, can drain away everything that you’ve been working towards.

I’ve seen that with so many businesses.

Benjamin Franklin said about such times:

“Beware of little expenses. A small leak will sink a great ship.”

That’s so true. Small cash leaks can hurt your cash flow real severely in the long run.

So take control of your cash flow. Audit your expenses now, and check if you are paying for what you need to be paying?

That’s how you have control over your cash flow.

6 | Keep Your Accounting Data Up to Date

I noticed how important it is when early during COVID times, around March-April 2020, my 14 clients wanted to know where they were cash-flow-wise.

They were all in a hurry, but I could not help most of them as fast as I wanted because it did not work like that. First, one needs up-to-date accounting data to prepare a cash flow statement. Only then a financial expert can analyze and tell where a business stands cash flow-wise.

So to stay on top of your cash flow situation, keep your accounts up to date all the time.

Another point worth understanding is that all the financial data to be processed to create a cash flow statement becomes financial information.

As an entrepreneur, you don’t care about accounting data, but you should care about financial information because financial data drives decisions.

And, when you want financial data to make decisions in your business, you want to have a cash flow statement, for which you need up-to-date accounting data.

It is the foundation of having visibility and knowing what’s going on with your cash flow. And with this knowledge, you control your cash flow.

7 | Set Aside Cash for Taxes

It’s easy to forget how much cash we have when looking at cash in our business bank account, including cash we need to pay as tax.

That money is in our bank account, but that is not ours. So the tax authority has the right to this money as soon as it turns up in our account, even though the tax payment date may be a little later.

The best way to set aside tax money is to open a second bank account. Use the money in this account to pay tax on time, every time.

This act of opening a separate bank account may look simple but is powerful.

Why? Because, as I said, an entrepreneur often thinks he is richer than he is when he sees all that tax money in the account. This behavior can put the business in crisis. There may be a point when a business can either afford to pay taxes or run the business. But, then they wonder which one they should use the funds for. And, often, they end up in a terrible situation.

I don’t want you to be in such a situation, even if you don’t want to open a new account, set aside funds to pay taxes to ensure that you pay them on time, without undue stress.

Once I finished sharing all these ideas with Steve, I asked him, “Steve, Do you find these ideas helpful, Steve?”

Steve replied, “Shishir, this is very helpful. I am writing all these tips to implement. What is the key to managing cash flow?”

And our conversation continued.

Shishir – “Steve, like I said, awareness around cash flow is key. For this, take responsibility for your cash flow. Understand the difference between what a bookkeeper does, what your accountant does, what you do, and what’s my role as your financial co-pilot of your business.

You have to have cash flow clarity, control, and confidence, so that you have financial stability sustainability, and the business is scalable at a sensible speed. As your business is growing at 41% revenue, you want to ensure it grows at the speed it can sustain. It’s very important.

Work with your bookkeeper, accountant, and me as a part of your extended team rather than working on a silo basis, where one person doesn’t know what others are doing.”

Steve – “What do I do now, Shishir? How do you improve cash flow, If you were in my position?”

Shishir – “Steve, if I were you, I would go back to implementing some of the tips I mentioned earlier to control cash flow. Go through them and find out which applies to you right now.

I would tackle the debtor’s list first. Work out who hasn’t paid, and it’s due by now, and ensure the cash collection process is in place.

Based on your cash balance and info received from credit control, you will have an idea of how much your cash balance will be at the end of this month. You know your normal monthly outgoings, and so you pretty much know your future cash position roughly after you have done credit control.

Update the cash flow statement to see the current cash situation and the project next month’s cash flow to have an idea.

Based on the future cash position, your cash flow decisions will change.”

Steve – “How do I implement all of this, Shishir.”

Shishir – “I want to introduce to you a new, simple way to control cash flow. It’s called the M.A.P. method. It’s a three-step proprietary process of how to manage, analyze, and project cash flow.”

I am sharing with you what I shared with Steve. Check it out to implement the same in your business.

The New Way To Implement Cash Flow Control Strategies – M.A.P. Method Of Controlling Your Cash Flow – How To Have Cash Flow Control Step By Step

When it comes to controlling cash flow, most people talk about managing cash flow. The key to success is managing cash flow and analyzing and projecting cash flow because you can’t manage something if you don’t know what to manage.

To analyze and project to have complete cash flow clarity, control, and confidence.

A cash flow statement allows you to do just that.

The Areas To Cover To Have Cash Flow Control

A cash flow statement is a power in your hands.

It allows you to take three key actions to control your cash flow. This, by the way, is equal to controlling your business and controlling its success.

These three key actions are:

- Managing Your Cash Flow (which you can remember with the letter M)

- Analyzing Your Cash Flow (that you can remember with the letter A)

- Projecting Your Cash Flow (You can remember with the letter P)

Because of these letters, I call it the MAP Method of Controlling the cash flow.

SUMMARY

In this section, we looked at the importance of cash flow control, why it can be the single biggest difference between a business being successful or failure. And How the M.A.P. method helps you to control your cash flow so that you have control of your business.

Let’s move to the cash flow management section next.