Introduction

From my experience working with established business owners and entrepreneurs over 20 years, this new guide will show you everything you need to know about cash flow projection as an entrepreneur or a business owner.

First, I will share with you the importance and tangible benefits of calculating projected cash flow.

Then, I will share the misconceptions and mistakes business owners and entrepreneurs make with real-life case study examples.

Then, I will share step-by-step instructions on how to create a cash flow projection with you.

Key Takeaways

- Cash Flow Projection is NOT the same as Cash Flow Forecasting- They are two different accounting concepts for different purposes.·

- He who sees the first wins. – Means when you can project your cash flow accurately, and by doing that, you can see your future cash flow; you can make financial decisions now to improve cash flow.

- Either you become competent in preparing cash flow projections or work with a cash flow specialist. It’s crucial to take responsibility on this part.

Let’s dive in.

Importance of Cash Flow Projection

At this moment in time, you might be concerned about the future of your business.

Therefore, you might have these burning questions to help prevent your business’s cash flow problems.

- How to secure a business’s financial future by making critical cash flow decisions that are

- How do I know the amount of cash needed to fund my next big project?

- How to integrate cash flow into the overall business plan?

Cash flow projections can help you to find answers to these questions.

From my experience, your business journey is filled with uncertainties and challenges. But with a solid grasp of cash flow projection, you’re better equipped to navigate them.

It’s a practical everyday tool I use for my clients that provides cash flow clarity and confidence. As a result of newfound confidence, making critical, informed decisions affecting the financial health of your business will be less overwhelming and fearful.

Did you know?

Studies have shown a direct correlation between an entrepreneur’s level of financial literacy and their business’s success. Businesses led by financially literate entrepreneurs are 33% more likely to succeed than those led by entrepreneurs with lower financial literacy.

This statistic underscores the importance of continually improving your financial skills as part of your business journey.

Who am I to guide you?

As a Fellow Chartered Certified Accountant (FCCA) and Cash Flow Specialist with over two decades of experience, I have assisted hundreds of clients in creating cash flow projections across diverse sectors such as dental practices, retail, marketing agencies, fine arts, and e-commerce, with annual revenues ranging from £40k to £53.8m.

I have been featured in leading media sites like Independent and global brands like QuickBooks Online, Zoho, Float app.

I am the founder of Hungry Cash Flow software and the creator of The Cash Flow Hub- The world’s most comprehensive cash flow resource online. I serve my clients through my consulting company, Hungry Cash Flow Ltd.

I am sharing these credentials not to brag but mainly to make you feel comfortable that you are learning from someone who does this for a living all day, every day.

Here is the video if you prefer to watch rather than read.

Let’s first understand what a projection is.

What is Cash Flow Projection?

Cash flow projection is your best guess about how you think the cash will flow in your business.

So, to predict future cash flow, you create a cash flow projection.

You can project cash flow monthly, quarterly, half-yearly, or yearly.

You can create a 30-day, three-month or 12-month projection.

What I have found as a best practice is that it’s a good practice to have a cash flow projection for at least three months on a rolling basis.

Then, you have time to plan for potential shortfalls or take advantage of any potential cash flow surplus.

Understanding the Tangible Benefits of Cash Flow Projection with real-life cash flow projection examples of my clients

Here are the tangible benefits of cash flow projection and real-life examples of my clients. I have changed the names to keep my clients’ privacy.

1. Predicting cash shortages and surpluses (Financial Risk Management)

Cash flow projections help you identify potential cash shortages before they become crises.

This foresight allows you to take proactive measures, like:

- adjusting your spending

- pursuing additional funding

- boosting sales efforts.

Just like Chris.

Chris’s Story (Event Management Business)– Making Cash Flow Decisions On Gut Instincts without a cash flow projection

Who he is?

Meet Chris. He has run a personal development event management business for over ten years. He wanted to grow his business.

What he did and where did he go wrong?

Due to COVID-19, live in-person events were affected, and he invested in technology to have live virtual experiences and live in-person experiences. This had a massive dent in his cash flow.

Chris didn’t realize how much cash he had to run day-to-day business and the extra money he needed to fund his next event.

What was the biggest cash mistake he made, and what was the misconception he had?

Chris’s mistake was to make these incremental cost payments without making a cash flow projection. As a result, he had negative cash flow for months and started pumping his cash into the business.

When his first event happened, he didn’t have the success he hoped for, and it further added fuel to the fire.

Lessons learned

Cash flow projection is a tool that gives you an idea of your future cash position if you do x, y, and z today and what it will look like if you don’t make any changes.

While driving, the further we can look, the more time we have to stay clear of potential hazards. It’s the same in business. When you have a cash flow projection in place, it gives you a pretty good idea of whether you can afford to do something or not.

2. Preparing for unforeseen events

In business, surprises are not always pleasant. Cash flow projections enable you to set aside reserves or arrange flexible credit lines to handle unexpected expenses, ensuring unforeseen events don’t derail your business operations.

Ruth’s Story (Marketing Coach)– Not Getting Ready For Funding When Times Are Good

Who she is

Ruth runs a business helping entrepreneurs improve their personal brand so they become magnetic in the eyes of their prospects.

She has been doing this for over 12 years. As a result, she has quite a steady stream of cash coming in.

Throughout her business journey, she has consistently grown by organically funding the company and never had an overdraft facility or a bank loan. As a result, she never felt the need to have an overdraft in place.

What she did and what went wrong?

Her business was growing at a pace she was not okay with. So, she wanted to scale up fast.

She invested a significant amount in a new mastermind program. She also changed her business model to release herself from being the bottleneck in her business. Unfortunately, the existing business slowed during this transition, and new step-up costs increased.

For your understanding, step-up costs result from making a big financial decision by hiring extra team members, doing a brand reboot, creating a new website, or renting an office. This is an investment that one makes to grow quickly.

Consequently, in the coming months as the operating expenses increased, customer payments slowed down and as a result her cash balance started to dry up. She wished she had an overdraft facility.

What was her biggest cash mistake, and what was his misconception?

Her biggest mistake was not getting an overdraft facility when times were good. She could have identified the cash flow gap had she made a cash projection.

Lessons learned

The best time to raise funding is when you don’t need it.

In the case of a bank, you might not want to take on debt before you need it. But you can build your cash flows so that when the time comes to raise funding, your finances are strong.

This is important because an investor or a bank denies funding when they are not convinced about the strength of the financials of a business and are in doubt about the ability of the company to pay back.

If you have solid financials and are financially savvy enough to communicate the value of a business, then you are in a great position to secure funding.

Otherwise, get a coach or expert to work with you to communicate your cash flow position and projections, someone who can confidently tell investors how much funding is required to grow the business and when they can repay.

Also, learn to read a cash flow statement, make cash flow projections, and, more importantly, communicate your cash flow position to investors.

Don’t postpone this because you never know when you need outside help to keep your business alive.

3. Facilitating Growth and Expansion by doing scenario analysis

With a solid grasp of your future finances, you can plan for growth initiatives more precisely. Cash flow projections can help you time your expansions, product launches, or market entries to coincide with your financial capacity.

Phil’s Story (Recruitment Business) – Inaccuracy Of Data For Cash Flow Projection

Who he is

Phil runs a recruitment business based in London, specializing in fintech.

What he did and what went wrong?

Phil put his time, money, and energy into placing candidates and never knew how to properly keep the accounting records or give this task to a bookkeeper who could do it for him.

What was the biggest cash flow management mistake he made

His biggest cash flow mistake was relying on inaccurate data to project.

Unfortunately, his accounting records were incorrect. So, he made the cash flow decision based on his inaccurate cash flow data, and his cash flow projection was way off.

Lessons learned

There’s a saying that garbage in and garbage out.

If the input is wrong and done incorrectly, the output will be wrong anyway. So

So, one of the fundamentals of making a cash flow projection is that the data on which to base the cash flow projection is accurate and current.

Phil learned it the hard way. However, he said he would not ignore keeping the accounting records current. He hired a competent bookkeeper to help him to do cash flow analysis accurately and then make cash flow projections.

4. Enhancing Credit Management

Understanding your future cash flow helps in managing debts and receivables more effectively. You can plan for loan repayments, negotiate better terms with lenders, and streamline your credit collection processes to ensure you meet financial obligations and maintain a healthy cash flow.

You can prepare best-case, worst-case and most likely scenario with in a certain timeframe so that you can prepare a realistic cash flow projection.

Whenever I prepare projected cash flow statement, specially for going for bank loan, I prepare best-case , worst case and most likely. This provides a lot of confidence to my clients when they present the information to the bank.

5. Building Investor and Stakeholder Confidence

A well-documented cash flow projection is a testament to your business’s financial foresight and stability. It reassures investors, partners, and stakeholders of your business’s viability and your capability as a leader, making it easier to secure investments and support.

Did you know…?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Richard Branson

Here’s the thing.

A common mistake entrepreneurs make is underestimating how cash flow issues can ripple through every aspect of their business. Late payments can lead to strained supplier relationships, inability to pay staff can cause morale and productivity issues, and lack of funds can halt growth initiatives.

Recognizing the far-reaching impact of cash flow helps underscore the importance of accurate projections.

Are you aware?

Businesses that maintain accurate cash flow projections are significantly better at making timely decisions. A study showed that companies with precise projections were 80% quicker in responding to changing market conditions and 30% more successful in avoiding financial distress. These statistics highlight the tangible benefits of accurate cash flow projection in enhancing business agility and resilience.

Example of Projected Cash Flow

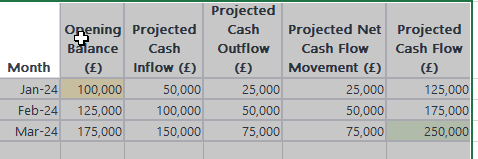

Let’s say it’s January 1, 2024, beginning of the period.

Your cash balance is £100k. This is the starting position.

You’ll use this to take the first step in the cash flow projection process, looking at the cash you will receive.

Project Cash Inflow For The Next Period From Accounts Receivable

Based on the previous sales period and current sales pipeline, make the best guess of your sales month by month for the next period.

Once you have done that, add the cash that will hit your bank account for those sales based on the terms of sales.

For example, you might make a sale on 18th Jan 2024, and the terms of sale state that a customer should pay within 20 days of purchase. In this case, you may not receive the cash until May, so record the projected money in the May column.

Based on your projections, you will receive a total of £ 300k – £50k, £100k, and 150k in January, February, and March 2024 respectively.

Now, let’s take a look at cash going outside.

Project Cash Going Out For The Next Period (From Accounts Payable)

Again, based on previous periods, make the best guess of expenses to pay for the next period.

Once you have done that, decide when you need to pay and how much you need to pay, and put the cash going out from your bank account.

For example, you might receive an invoice on 18th January 2024, and if you are going to pay in may month, record the projected cash going out in May.

Based on your projections, you will pay a total of £150k – £25k, 50k, and 75k in January, February, and March 2024 respectively.

Now you have projected cash inflow and cash going out for the next three months, month by month, let’s look at the projected net cash flow movement.

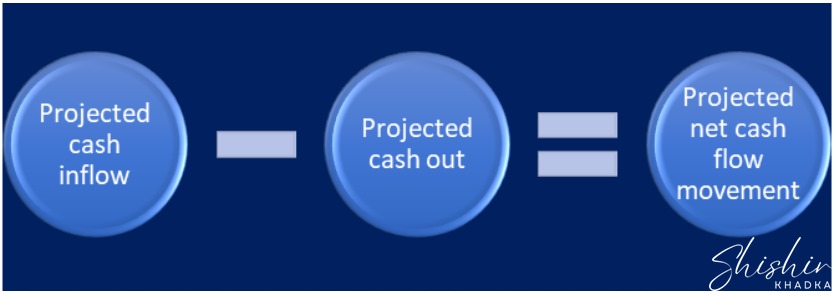

Take Away Projected Cash Out From Cash In

This is the formula for net cash flow movement.

Projected cash inflow – projected cash out = projected net cash flow movement

In the example I have shared with you,

Projected cash inflow (£300k) – projected cash outflow (£150k) = projected net cash flow movement

( £150k)

Now, do a final thing, which is to:

Find Your Projected Cash Flow

Once you have established net cash flow movement, add an opening bank balance to have projected cash flow.

Projected cash flow = opening bank balance + estimated net cash flow movement

So, in the example:

Projected cash flow = £100k + £150k = £250k

What does this tell you?

This tells you that your cash balance will be £250k at the end of March 2024, provided your estimated cash collection and cash payments happen as projected.

Here’s the summary of the figures

- Opening Balance (£): The cash balance at the start of the month.

- Cash In (£): The projected cash inflow for the month.

- Cash Out (£): The projected cash outflow for the month.

- Net Cash Flow Movement (£): The net movement of cash for the month, calculated as Cash In minus Cash Out.

- Closing Balance (£): The cash balance at the end of the month, calculated as the Opening Balance plus the Net Cash Flow Movement.

As per the projection, the cash balance starts at £100,000 in January and reaches £250,000 by the end of March.

Using Cash Flow Projection to make financial data driven decisions

Imagine how powerful this information is.

Now you know,

- You have £250,000 at the end of March 2024 which is enough cash to pay all the bills and can go on holiday without worries.

- Now, you also know as projected net cash flow is increasing by £25k every month, you have cash needed to fund your next big project. You can afford to make a significant investment, such as moving on to bigger premises, hiring new staff, updating websites, etc., without affecting the cash you put aside for the day-to-day running of the business.

- You also know if you will have any shortfalls and can borrow money to cover those shortfalls.

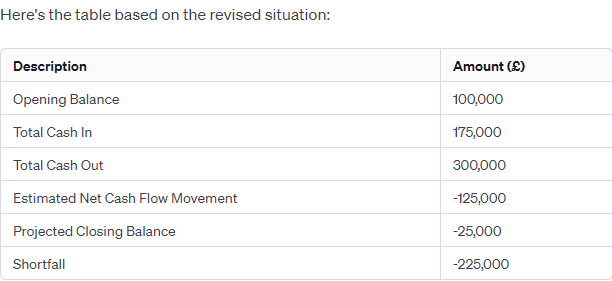

Let’s assume the cash came in, and the cash out was the exact opposite of what I shared.

So the cash comes in a total of £175k, and cash out is £300k.

The net estimated net cash flow movement = £175k-300k = £125k

But you only have £100k in your bank on 1 January 2024.

So you will have a projected cash flow balance of £25k = £100k – £125k

- Opening Balance: The initial cash balance at the start.

- Total Cash In: The total cash inflow from all sources of cash

- Total Cash Out: The total cash outflow.

- Estimated Net Cash Flow Movement: The difference between total cash in and out, indicating the overall movement of cash.

- Projected Closing Balance: The final cash balance, taking into account the net cash flow movement and the opening balance.

- Shortfall: The amount by which expenses exceed the available cash and the initial balance.

Now you have time to:

- Ask for a loan from the bank or seek an investment

- Cut costs in advance

- Change your commercial decisions to alter estimated net cash flow movement.

Not knowing where you are today and in the near future in cash position is one of the biggest killers of the business, and cash flow projection saves you from this killer.- Shishir Khadka

It’s a bit like a Titanic before it hit an iceberg. Unfortunately, by the time the crew realized the danger, they had lost all the options to avert the tragedy.

If you don’t realize that you don’t have enough cash to cover the bills and just come to know it in real time, you won’t have enough time to seek external funding.

Being in such a situation is an accident waiting to happen. In business, it’s called a business failure. However, you can avoid it by making a cash flow projection.

Cash Flow Projection challenges faced by business owners and entrepreneurs

My practical encounters suggest that preparing cash flow projection is a bit like predicting the British weather – unpredictable and often overlooked.

From my experience of working with business owners and entrepreneurs over the last two decades, you might be facing one of these three cash flow projection challenges.

1.Predicting Future Cash flows

Predicting future cash flow is hard. – It’s full of what ifs.

You have to take into account of seasonal trends, economic shifts like for example steep interest rates from .1% to 5.25% and inflation from 2.9% to 10.1% last year.

How do you overcome this challenge?

Your past guides the future.

Meaning you have to look at your past cash inflows and outflows and build a cash flow projection.

Pay attention to the followings:

- Trends– Growing or declining of sales, costs and expenses?

- Patterns– Is there any patterns of cash collection and cash payments?

By going through these you will have a clear picture of cash projection.

2. Financial Skill Gap: Not Everyone’s a Financial Whizz

This financial knowledge gap can make cash flow projection seem daunting.

Yes, not everyone is a financial whizz. And that’s okay. You don’t have to know everything how to do in your business.

After all , we are all humans. We are strong in some areas and some areas we are not so good.

What is the fix?

Invest time in being familiar with understanding of how cash flow works. Understand the essential concepts of cash flow management. If required work with a cash flow specialist to speed up your learnings. It will pay you dividends for a long time.

3. Cash Flow Tool Trouble: Not having a tool or having a wrong tool

Most business owners rely on future cash position by looking at their current profit and loss statement and add few months keeping the same figures of the same period last year .

Here’s the problem with that.

P&L report doesn’t give you the cash flow report unless the timing of receipts and payments are the same as when the products or services are sold or consumed. Which is very unlikely.

So what are your options?

Either you can go through the bank transactions that are reconciled and manually prepare cash flow projection in a spreadsheet

OR

You can simply use one the cash flow projection tools like Hungry Cash Flow, Agicap, CashAnalytics to simplify and prepare the cash flow projection faster.

From my experience, the reason why you may be facing these challenges is because you may have certain myths or misconceptions about cash flow projection.

Myths About Cash Flow Projection

Many cash flow projection-related myths stop businesses from projecting cash flow.

Here are the most prominent of those myths.

1.Cash Flow Projection vs. Cash Flow Forecast – Terms Interchanged

While working on your projections, remember the distinction between cash flow projection and cash flow forecast.

A projection is usually a what-if scenario, while a forecast is an expectation based on current data.

This is why the cash flow forecasting process and projection process differ. Both are helpful tools but serve different purposes in your financial strategy.

2.My Business Is Too Small. Do I Still Need A Cash Flow Projection?

It’s not about how small or big your business or numbers are.

A business doing £1milion in revenue and having £100k in the bank is equally concerned about survival and growth as a business doing £100k in revenue and having £10k in the bank.

The risk may be different, but the dynamics are the same.

If you don’t know how to manage and project cash flow in a £10k revenue business, chances are you won’t be able to do it in a £100k business if you reach there.

3.It’s Too Complicated. I hate math, and I am a creative person.

You don’t have to go to the gym to get fit. You can eat and sleep right, walk or run outdoors and get fit. Similarly, you don’t have to be a math’s whiz to develop financial literacy.

I brought up financial literacy because it is one of the most crucial skills for an entrepreneur, and it helps you grow your business profitably and sustainably.

As Warren Buffet says, “The language of business is accounting.”

If you don’t know the language, then how will you communicate?

So take time to learn it, even if you are a creative entrepreneur. Next, get help from someone who understands the numbers better, like a cash flow coach.

4. It’s The Job Of My Accountant And Bookkeeper

Most businesses employ accountants and bookkeepers to manage their finances. Still, 82% of companies fail because of poor cash flow management and understanding of cash flow.

I believe you can outsource the task of managing cash flow, but you cannot outsource the responsibility of managing it because it’s your cash flow

-Shishir KhadkaShishir Khadka

So please take responsibility for your cash flow to be among that 18% who have control over their cash flow and win.

Having debunked these common myths, it’s crucial to look at specific pitfalls to avoid, ensuring your cash flow projections are as accurate and effective as possible.”

Cash Flow Projection Pitfalls faced by business owners

Here are the top five cash flow projection mistakes I’ve observed, and trust me, avoiding these can be a real game-changer for your business.

- Neglecting the Importance of Timing of Future Projected Cash Flow

- Overlooking Seasonal Variations and Industry Cycles

- Failure to Plan for Contingencies

- Relying Solely on Historical Data

- Ignoring the Impact of Business Decisions on Cash Flow

Types of Cash Flow Projection Models

Understanding different cash flow projection models is crucial for navigating your business’s financial strategies. These models serve specific purposes, helping you align with your business’s needs and goals.

Let’s explore them to achieve financial stability.

1. Short-term Projections: Purpose and ideal scenarios for use

Short-term projections are essential for planning and daily operations. They help with immediate expenses, seasonal changes, campaigns, and financial choices. Be flexible and responsive in the dynamic business environment.

2. Long-term Projections: Strategic planning and future growth

Long-term projections are essential for your business. Use them to plan, set goals, and make decisions. They help you prepare for expenses, loans, and expansion. They are the roadmap to achieving goals.

3. Combination Approach: Balancing short-term needs and long-term goals.

Use both short-term and long-term projections to manage your finances effectively. This way, you can meet immediate needs while working towards future goals, aligning your decisions with your long-term vision.

You can go deeper into this by selecting basic cash flow projections or detailed cash flow projections to make cash flow predictions.

Here’s what I believe

Short-term projections are like a car's dashboard. They give immediate information. Long-term projections are like a GPS. They provide a wider view and direct you to your destination. Both help you stay balanced and informed. They reduce surprises and increase preparedness.

Shishir Khadka

Step-by-Step Guide to Cash Flow Projection

Creating a cash flow projection might seem daunting, but with a step-by-step approach, you can build a forecast that helps you confidently steer your business.

Let’s break down the process into manageable steps, turning complex financial planning into a straightforward roadmap.

Step 1: Review

Review the last three months’ cash in and cash out – so that it is a foundation for projection

Step 2: Establish

Establish Cash in hand position

Step 3: Debtors

Debtors review – allocated cash as to come in relevant months – constant on a weekly basis

Step 4: Payment

Payment outgoing – weekly basis and negotiate supplier – to delay payment saying I don’t have business at the moment- allocate the budget

Step 5: Take advantage

Take advantage of immediate government backing like for e,g. vat deferral payment, cash grant – Be updated to with HMRC payments. check out HMRC site for your options

Step 6: Seek

Seek for bank funding and make it available and only pay for interest if you have to use it

Step 7: Review

Review cash to come every two weeks to ensure cash to come is accurate.

You can watch over my shoulder how to implement cash flow projection in 7 steps

Incorporating Cash Flow Projection Automation Tools and Cash Flow Projection Template

Cash flow projection automation tools automate data entry, calculations, and analysis. This saves time and reduces human errors. They sync with accounting software, providing real-time data and insights.

They also allow for quick adjustments and what-if scenarios, making it easy for users to explore financial strategies. Data visualization features help users understand their financial situation quickly.

Recommended tools and software

There are different tools available for cash flow projection. Excel spreadsheets and Google Sheets are suitable for simple predictions. However, you run the risk of manual data handling.

Hungry Cash Flow, QuickBooks Online Planner, Xero and Agicap are software options for more advanced needs. These tools offer integration with accounting software, scenario planning, and detailed analyses.

You can see below how Hungry Cash Flow maximisation software accurately prepares the report reducing risk of manual data handling by connecting to QuickBooks online. This makes the process efficient and scaling the preparation of cash flow statements faster.

Use this cash flow projection template

If you are not in a position to invest in cash flow software, then you can simply download this cash flow projection template I have created and make it your own. Based on the nature of your business, you need to customise the categories of income and expenses, time frame and assumptions.

If you are unsure how to prepare cash flow projections, follow my video walkthrough guide with an example.

Best Practices For Cash Flow Projection

- Make sure to keep your cash flow projection updated. The business environment is constantly changing, so being consistent is crucial.

- Set a schedule for reviewing and updating your projections. Decide on the frequency that suits your business and stick to it. From my experience, a 12 months projection is the most common one to follow.

- It is always good to have an extra pair of eyes and ears. So, work closely with your accountant or a cash flow specialist to help you with this aspect. From my experience working with my clients as their cash flow CFO, it saves them time and hassle and sometimes even saves the business from collapse.

How External Factors may impact your cash flow projection

When it comes to building projections, you may have certain factors, which are internal factors like access to your past financial data to predict future data or access to a financial advisor as a guide.

But, you will also encounter external factors that are not in your control.

Like for example, changes to consumer habits and buying conditions.

For example, one of my clients, who sells luxury sofas, is based in Fulham, London.

During Covid, his business grew by 27.2% across all product lines.

This was because everyone had to stay home, so the online sales rocketed.

To keep up with the demand, I helped the client prepare monthly cash flow statements of actual cash inflow and outflow.

Based on cash flow statements and reviewing sales forecasts, I regularly updated cash flow projections to ensure the cash flow could sustain the steep business growth.

Conclusion

I will wrap up the guide as I believe I have covered everything you need to know about cash flow projection as an entrepreneur or a business owner.

If you need to dive into specific sections of cash flow projections, from creating cash flow projection templates to actually implementing them step-by-step, I have got you covered.

You can navigate into what you need to know right now.

I will leave you with some external resources for you to become confident in creating cash flow projections.

Your Next Steps

You can go deeper into specific areas of cash flow projection, from selecting models to methods and detailed step-by-step cash flow projection, by following the relevant links.

You can also follow the cash flow projection training section.

You can watch my YouTube channel for more educational and actionable videos on this topic.

Download the exact Cash Flow Projection Template Shishir uses to prepare projected cash flow statement for his clients and make it your own

External links: Check out